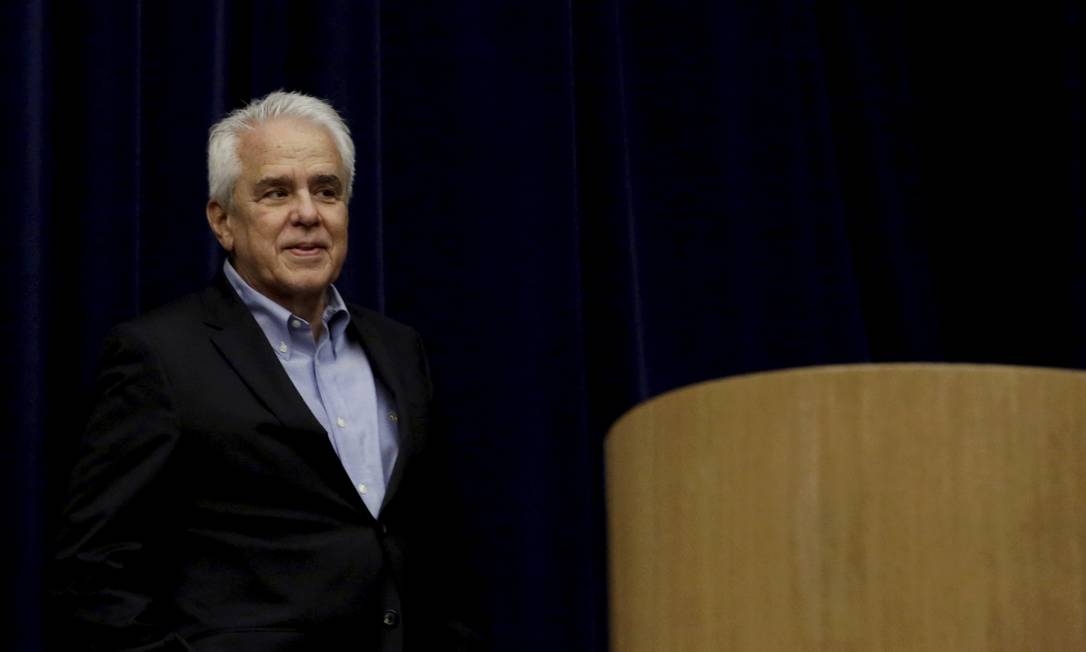

Ryo – O Administrative Board From Petrobras, Renewed at a shareholder meeting At the start of the week, it meets Friday in the final step of what the market saw as interference by President Jair Bolsonaro in the country’s largest state-owned company: the appointment of Reserve General Joachim Silva e Luna to head the company.

Luna, who has been elected as one of seven government representatives on the council – which has 11 seats – should be elected president of the state-owned company instead of Roberto Castillo Branco, Who was fired amid Bolsonaro’s dissatisfaction with the state’s fuel pricing policy. The executive was formally sacked on Monday.

What Luna intends to do with the fuel price adjustment system to please the president and avoid losses to the company that displeases small shareholders is one of the main uncertainties in the market.

But there are other challenges for the general. Check out the top 5:

1 – New board

With the resignation of Castillo Branco four of the eight directors Make their posts available. And the general has already indicated it You intend to recruit names internally To promote a smooth transition in the company.

He will need executives in the areas of exploration and production, production development, marketing, logistics, finance, and investor relations, among others.

Silva and Luna have also indicated that they want to End of the home office of the board. He himself is already sending in the headquarters of the state-owned company, in downtown Rio.

Controls: State-owned summits have undergone successive changes under pressure from Bolsonaro

2 – Pricing Policy

Market experts and analysts expect fuel pricing policy to change.

Currently, the state-owned company tracks, with frequent adjustments, changes in oil prices on the international market and in the exchange rate. And so, since January, Gasoline accumulates at a high rate of about 40%; Diesel rose 30%Not counting the increase announced on Thursday.

The general challenge would be to change this policy without exposing the company to significant financial losses, which would displease small shareholders and penalize the company’s market value on the stock exchange.

3 – Gas Market

When Petrobras announced the last 39% rise in the price of gas Aiming at distributors, President Jair Bolsonaro again criticized Petrobras’ pricing policy. He indicated that there may be changes.

Despite the passage of the new gas law through Congress, and the state-owned company signed an agreement with the Administrative Council for Economic Defense (Cade) to open space for competition in this sector, experts indicate that private companies cannot access passive spaces in gas pipelines, which can To lower prices.

Today, even with some Petrobras gas pipelines selling, the state-owned company has it Contract use of these networks With companies that bought these assets, negotiations with the National Petroleum Agency (ANP) are not progressing.

Cute decorations: Dinner with businessmen is futile to correct the direction of the government

4- Selling assets

Silva and Luna will face the challenge of maintaining the Business Sale program to reduce the company’s high indebtedness, but the plan faces strong opposition from the oil unions.

At the end of March, Petrobras’ board of directors approved the sale Landolfo Alves Refinery (RLAM), In Bahia, for Mubadala, a United Arab Emirates investment fund. The fund will pay $ 1.65 billion per unit.

Now, the question is whether the new management will maintain the asset sale schedule as a way to reduce leverage. Today’s goal of the state-owned company is to drop between $ 25 billion and $ 35 billion by 2025.

Contributors: Petrobras cancels the FUP injunction and meets to approve the Balance Sheet

5- Investment after salt

There is an expectation that the new management of the company will again make investments beyond pre-salt, developing projects in different parts of Brazil.

The company is currently focusing on developing high-yielding pre-salt fields in the Santos Basin.

Over the next few years, Petrobras intends to make annual investments ranging between $ 10 billion and $ 12 billion.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!