Caixa Econômica Federal began launching a new microcredit, in April of this year, for individuals and for those who qualify to work as Individuals Small Entrepreneurs (MEI). up values Up to 3,000 BRL And it can even be issued to negative people, that is, with dirty names.

The loan liberalization should serve approximately 4.5 million workers in the first 12 months of the program’s launch. See the release rules for each case below.

Who can get up to R$3,000 in the form of a CAIXA microcredit?

According to the microcredit release rules, the normal person You can apply for a loan of up to R$1,000, with a monthly interest rate of 1.95% per month and 24 months for payment. To get the refund, you don’t need a lot of bureaucracy, as the contract can be completed directly through the Caixa Tem app, just agree to the loan terms and wait up to seven days for analysis.

On the other hand, the Simplification of Digital Microcredit Program for Entrepreneurs (SIM Digital) has different rules. In this mode, you can order Individual Small Entrepreneurs, in a fixed amount up to a maximum of 3 thousand Brazilian riyals, and it can be divided into 24 monthly installments. The rates are up to 1.99% per month.

Individuals and MEI organizations engage in productive activity with a total annual income or return of R$360,000. The government considers individuals to be “individual entrepreneurs.”

It is important to highlight that the value should be used for the work of the worker, to increase the working capital, or to buy inputs or invest in equipment and utensils which favors the increase in production in the activity of the worker.

According to information from Caixa, at the time of contracting, the user must provide an acknowledgment of the use of the available amount, through an interactive test on financial education and informed use of released credit (from R$1,000 to R$3,000).

What is CAIXA’s new microcredit limit?

As stated in the context of the article, for individuals, the credit limit is R$1,000. The repayment term is up to 24 months, with interest starting from 1.95% per month (26.08% per annum).

The MEI credit limit will be R$3,000, with a repayment period of up to 24 months and an interest rate of 1.99% per month (26.68% per annum).

When can I receive the loan amount?

According to the information released by CAIXA, the balance of R$1,000 or R$3,000 will be released within 10 days, starting from the date of the registration update. After approval, the customer can contract the amount and resources that will be immediately added to the account.

where to order

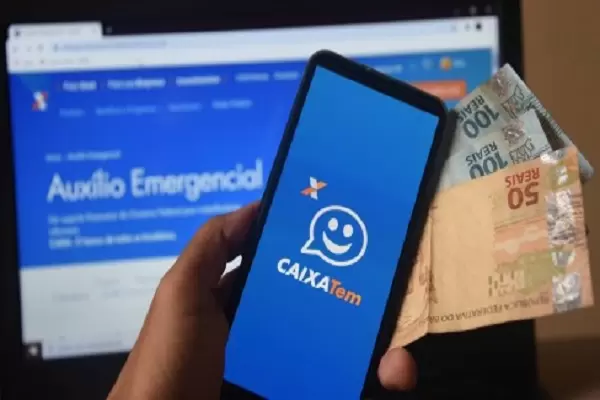

A loan of R$1,000 will be released to individuals directly through the CAIXA Tem app. For those who are MEI, an amount of 3 thousand RRL must be requested at the Caixa branch.

Can I apply for a small loan if my name is dirty?

Citizens with dirty names can apply for a small loan of R$1,000 or R$3,000. You will have access to loans including those with a bad (negative) name at credit analysis institutions, such as Serasa and SPC Brasil.

How to use Caixa Team?

After downloading the application, the user must perform the registration update in Caixa Tem. For this, the application asks the user to scan the identity document, send a “selfie” and report the monthly income.

In the case of MEI, credit must be requested at agencies. To be hired, a citizen must have an account with Caixa, have 12+ months of bills such as MEI and provide proof of residency, personal and company documents.

See what success is on the Internet:

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!