a nubank Announce the launch of another novelty that can help people who don’t want to compromise their credit card limit or who currently don’t have money. this is the jobadditional limitwhich makes it possible to pay vouchers using extra credit on Lilac (Nubank card alias).

Read more: Pix in installments: Nubank launches a new transfer method

The idea of novelty works in a very simple way: basically, customers receive an additional marginal value on their own Credit card to pay the bills. That is, the service acts as an additional amount that has nothing to do with the traditional limit of the instrument. However, its use shall be exclusively restricted to the user to settle an account.

With practice, customers can increase their purchasing power while still leaving the card’s regular limit available to use as they wish.

What is the amount issued in Nubank Extra Limit?

There is no exact amount because each credit varies from person to person. Nubank announced that it uses the same criteria for a normal credit card limit. For this, an algorithm is used that is constantly being fed new information about the user’s history.

The company stated that it analyzes all data before creating a credit line, and as a result, the purchasing power offered may vary from person to person.

The customer finds out how much extra limit he got when paying a bill with a credit card. Thus, if this limit is released, Nubank advises the option when a person chooses a credit card as a method of payment.

It is worth noting that no additional amount is charged for using the extra limit. The tax on operations (IOF) and interest are the same as for paying bills with a traditional credit card.

How to pay boleto with extra limit?

The step by step process to perform the procedure is as follows:

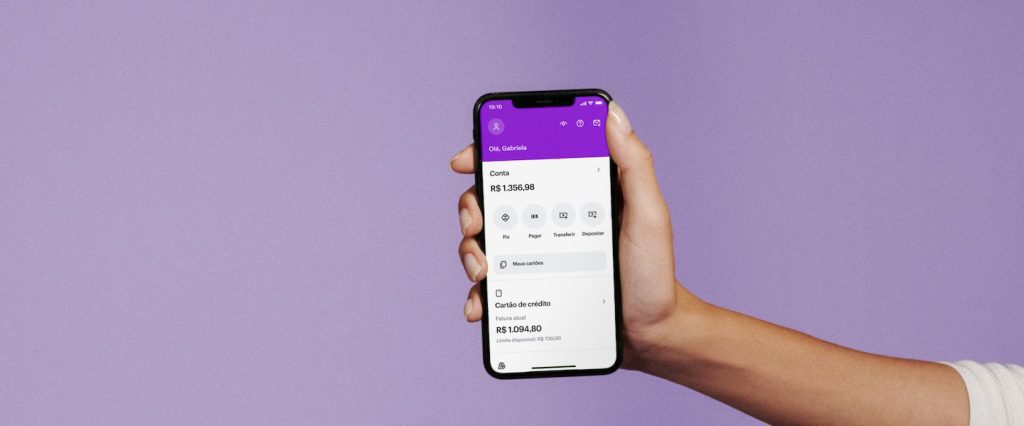

- Open the Nubank app;

- Then, on the main screen, click on “Pay”;

- Go to the “Pay Bills” option;

- Scan the ticket or enter the barcode numbers;

- Click on the “Choose a payment method” tab. If you have an additional limit available, this information will be visible;

- Next, press “Credit Card” and select the number of installments;

- Don’t forget to review your payment information;

- Select the “Payment” option and enter the 4-digit password to confirm; And the

- ready!

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!