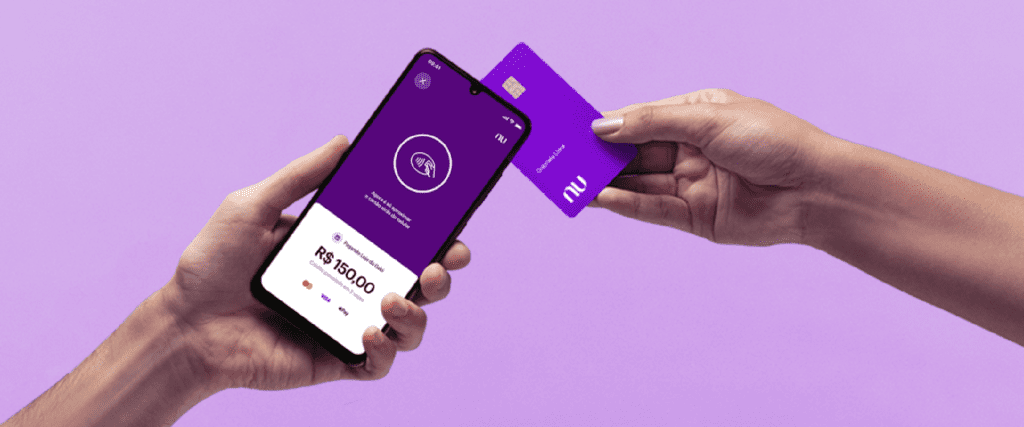

a nubank It gives a credit card (the famous “roxinho”) that Brazilians look for so much. The advantage of fintech is that the application itself can consult all the transactions made using the device.

This way, if you don’t recognize a purchase made with purple, know that the transaction can be cancelled. The first thing to do is to contact the facility where the purchase was made.

Credit operators do not have the independence to cancel any purchases, therefore, for cancellation, it is necessary to turn to the company for which the transaction was made.

In short, the user will object to the purchase through the chargeback process.

How do you cancel a purchase made on a Nubank credit card?

- access to the Nubank app;

- Click on the “Nubank Credit Card” tab;

- Go to the View Invoice option;

- Find the purchase you want to cancel;

- Press “Report a problem”;

- Specify the reason for cancellation;

- This was done, and nubank will direct you to contact the facility;

- If there is no response, click “Continue Anyway”;

- Finally, submit proof of payment to open a purchase dispute request.

In what cases can I object to the purchase?

To claim a purchase, it is necessary that it be suitable in one of the following cases:

- If you have purchased one product and received another;

- If the merchandise is defective and has not been replaced;

- If you do not recognize the purchase on the invoice;

- If you regret the purchase within the permitted period and did not receive assistance from the store.

What are the deadlines for canceling a purchase?

The user must respect certain deadlines to cancel the purchase Credit card from Nubank. In cases of remorse, for example, the deadline for withdrawal from the contract or purchase is 7 days.

Regarding opening a dispute, the limit usually extends to 120 days after purchase. However, all of this will depend on the fintech credit card company’s policies.

How to increase your nubank card limit

- avoiding delays in paying bills;

- Payment before the due date or by the due date;

- Choose the bill due date according to your salary payment;

- Do not pay the minimum invoice amount, as this will activate the revolving credit;

- Keep your monthly income updated in the app nubank;

- Frequent use of your credit card;

- Use the card more often without going over the limit;

- You don’t have debts.

Another factor that can help a customer get a higher limit is not having his name polluted in credit protection agencies, such as SPC and Serasa. Being negative causes your credit score to drop quickly, thus reducing your chances of hitting an upper limit.

See what success is on the Internet:

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!