IR: Check how much you will pay if the new schedule is approvedMarcelo Casal Jr. / Agencia Brazil

in a day

Posted on 06/25/2021 19:42 | Updated on 06/25/2021 20:15

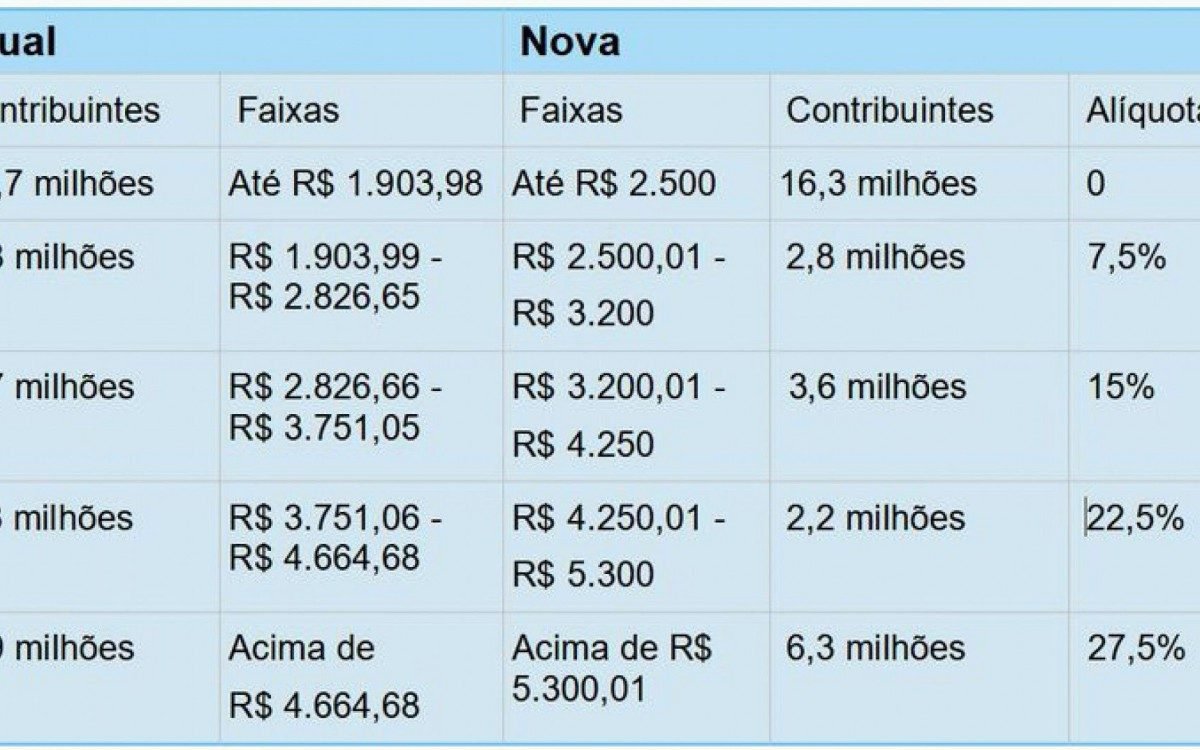

Brasilia – A change in the income tax schedule will cause Brazilians to pay less tax. According to the proposal sent by the federal government on Friday (25) to Congress, the exemption limit for individuals will be increased from R$1,903.98 to R$2,500.

Also according to the proposal, the amount of tax paid will be reduced to the following income brackets. paying off:

Income: 1.5 thousand Brazilian riyals

Amount Paid: 0 Brazilian Real

How much will you pay: 0 BRL

Income: Rls 2000

How much is paid: 7.20 BRL

How much will you pay: 0.00 BRL

Tax Reduction: 100%

Income: 2.5 thousand Brazilian riyals

Amount paid: 44.70 BRL

How much will you pay: 0.00 BRL

Tax Reduction: 100%

Income: 3 thousand Brazilian riyals

Amount paid: 95.20 BRL

How much will you pay: 37.50

Tax reduction: 60.6%

Income: 3.5 thousand Brazilian riyals

How much to pay: 170,20.000

How much will you pay: 97.50.000

Tax reduction: 42.7%

Income: 4 thousand Brazilian riyals

How much do you pay: 263.87

How much will you pay: 172.50 BRL

Tax reduction: 34.6%

The tax cut is part of the second phase of tax reform and was a campaign proposal by Jair Bolsonaro. At the time, he even promised to increase that limit to R$5,000, which ended up not being verified.

Sending a Message

In the morning, the official delivery of the proposal to Congress was celebrated, but until about 17:00 the room was still waiting for the official presentation of the text, the radio reported, and the document was not recorded in Casablanca. the system.

The project provides for expanding the exemption limit for individuals from 1.9 thousand Brazilian riyals to 2.5 thousand Brazilian reais, reducing corporate taxes, the rate of profits and dividends.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!