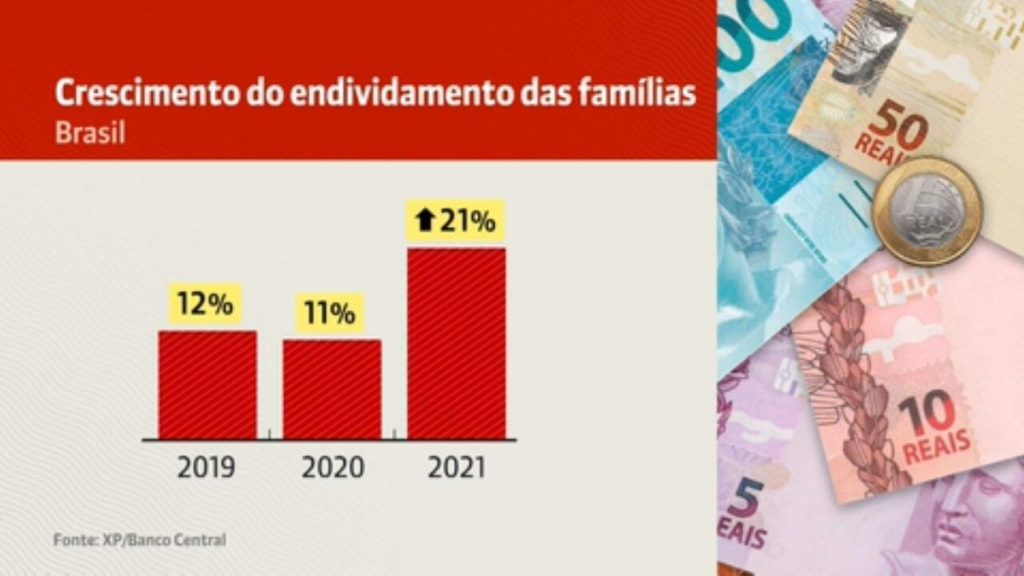

Brazilian household indebtedness grew 21% last year compared to 2020. The increase was driven by more expensive and unsecured lines of credit, according to a report by the fixed income team at XP based on data from the central bank. With the rise, indebtedness began to consume more than half of the household’s income.

According to the study, the two most expensive types of credit – with above-average growth – are credit card (up 34% from the previous year) and non-deposit credit (37%). Both are from the so-called “clean” fonts, that is, without guarantees.

“Because we live in a context of high inflation, greater income commitment, and a high level of indebtedness, these lines, which are naturally more prone to default, may begin to show an exacerbation in the event of default,” highlights an excerpt from the report .

Family Indebtedness Growth – Photo: Economy G1

Brazilian household indebtedness has reached a high level in the historical chain of the Central Bank. “It has grown significantly, reaching 51% in October 2021 (latest available data),” says the XP report.

In the opinion of economist Camila Dolly, Head of Fixed Income at XP Research, the rising indebtedness is a cause for concern since the current base interest rate of the Brazilian economy, Selic, has not yet been fully reflected in the contracts for these credits. And when that happens, within about a year, those debts tend to grow more, which can lead to even bigger defaults.

“The problem with this growth is that credit means interest and that generates a weight of interest that they also have to pay over time and an important point that is good to talk about as well. It has not yet been fully reflected in debt costs, because it takes about one year, between a decrease Or the interest rate rises, and this is passed in borrowing costs.”

Also, according to the economist, credit has played a “counter-cyclical role”, by “holding back” the country’s economy over the past two years, one of them due to the recession caused by the COVID-19 pandemic.

“The last couple of years, with all the panorama we had in the economy, credit has played a very important countercyclical role, the economy has been limiting activity and providing credit, in a certain way, making the economy a certain way in the last few years, and it’s been increasing. , we saw families becoming more indebted. This leads to more indebtedness to families, and this is what we saw in the data released by the central bank,” the economist explained.

Household indebtedness has grown “significantly, reaching 51% in October 2021 (latest available data),” according to the report.

The study highlights that the decline in household income is one of the factors that explain the increase in indebtedness. And that the fourth quarter of 2021 recorded a slight increase in individual default indicators.

Among the legal entities, that is, companies, the increase in credit in 2021 compared to the previous year was 11%, which is a level much lower than that recorded by the group of individuals.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!