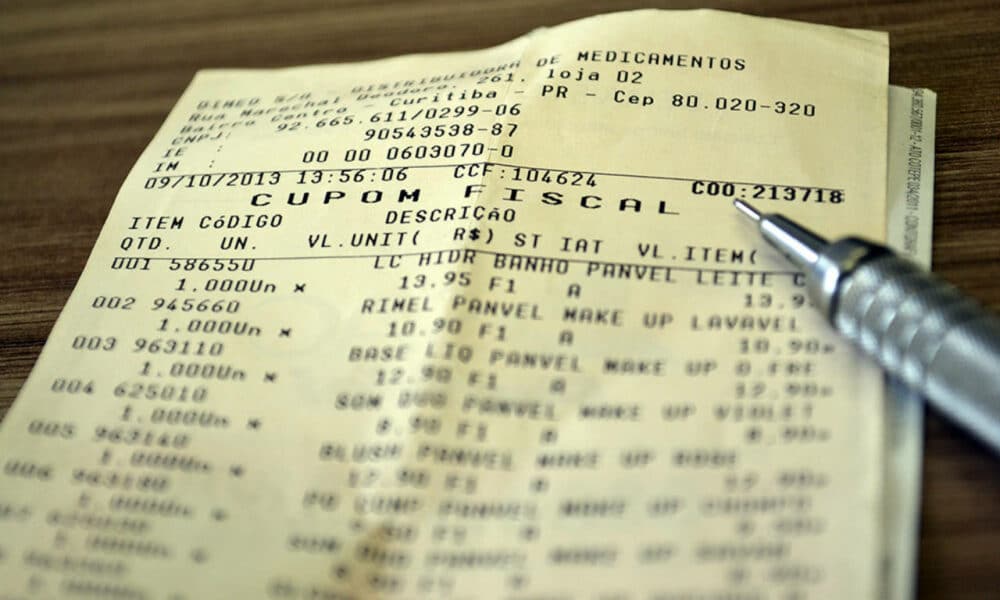

In an initiative aimed at combating tax evasion and rewarding Consumersthe CPF na Nota program has emerged as an effective tool on the national scene.

This strategy encourages consumers to record their CPF numbers on invoices, promoting stricter inspection by the Federal Revenue Service and, at the same time, offering attractive prizes to participants.

CPF in note and the complex Brazilian tax network

CPF na Nota acts as a valuable ally in the fight against tax evasion. When a CPF number is included on invoices, purchase information is automatically sent to the Federal Revenue Service. This process simplifies the monitoring and inspection process, ensuring that taxes are collected correctly by traders.

Direct benefits to the consumer when registering a CPF

However, the program is not only useful tax authority. Consumers who adhere to the Partnership Policy Framework (CPF) included in the memorandum have the opportunity to receive prizes. A big prize of R$10,000 was recently announced for those who chose to register their CPF number on their bills.

In addition to cash prizes, many companies offer loyalty programs linked to the CPF on the note. Each registered purchase accumulates points, which can be redeemed for discounts, products or services. This approach results in savings in the medium and long term, providing real benefits to consumers.

State initiatives and additional benefits

In addition to the national programme, several Brazilian states have implemented similar initiatives. For example, Nota Premiada Bahia gives e-tickets to monthly draws for every purchase made with a registered CPF.

States such as Rio Grande do Sul, São Paulo, Maranhão and others have their own programmes, replicating the benefits of the Strategic Partnership Framework contained in the memorandum at the state level.

Simple participation: registration and consultation in the CPF na Nota programme

To join these programs, you must register on the official website of the corresponding state program. Including CPF on all purchase invoices is the next step, allowing consumers to check the rewards and discounts accumulated through online platforms.

CPF participation in the memorandum not only contributes to tax screening, but also becomes tangible and accessible incentives in the consumer's daily life.

By revealing benefits Through this program, consumers become an active part in promoting financial transparency, while enjoying exclusive benefits.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!