Passive workers can contract loans of up to 100 thousand Brazilian riyals NS Federal Savings Bank. However, the standard is that the asset is positioned as security for the contract.

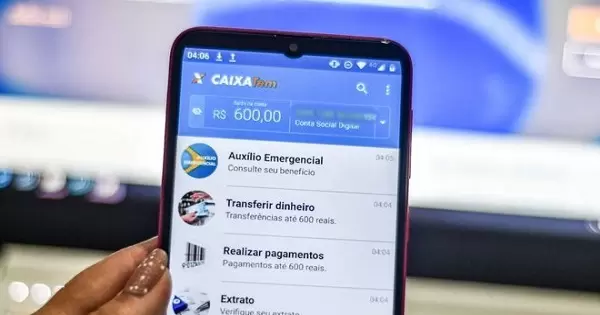

see also: Can I actually request a credit from R$300 to R$1,000 in CAIXA Tem? See the calendar

Therefore, it is important to stress that both the approval and value of the credit will depend on the assessment of the mortgaged asset. In this way, even if a citizen has a bad name, it is possible to get the loan.

Among the items that can be placed as collateral: watches, silverware, first-class pens, jewelry and even FGTS. The mortgaged asset must be delivered to the institution at the time of contracting, and it is returned only at the end of the debt repayment.

How to apply for credit for negatives?

You may also like:

In advance, it is necessary to have an asset that can be placed as collateral. If you have a branch, check the Caixa Econômica branch that offers the credit method, being the closest to you. Once this is done, go to the bank and present your ID document, CPF and proof of address.

At that time, it will be necessary to inform you of your desire to contract with the Credit Penhor Caixa Program. Remember that the item that will be placed as collateral must be taken for evaluation.

In this way, if the asset is located in the parameters according to the category, the enterprise will contract the loan. It should be noted that the number of installments and the method of payment will be determined at that time with the customer.

However, if the warranty is FGTS, the Caixa Branch Manager must perform a calculation to determine the amounts and terms of payment. With all the steps completed, the bank will deposit the funds.

FGTS Warranty

The Separation Compensation Fund (FGTS), in which Caixa manages the payments, can also be used as collateral for loan repayment. In this case, the problem of defaulting on installments is solved by direct withdrawal from the FGTS of the amount corresponding to the debt.

In this form, the amount awarded is 10% of the available balance in the fund account and 40% of the penalty in case of unfair dismissal.

The company must, upon request, have committed to the service. In this case, the citizen should contact the Personnel Department (DP) or the Human Resources (HR) sector for more information.

Read also:

It’s “pressure” on the Internet:

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!