Caixa Econômica Federal announced Monday (27) the “Caixa Tem” credit. According to CEF, about 100 million customers may order it. Loans range from R$300 to R$1,000 and can be contracted directly via the cell phone.

The registration update and credit request, subject to approval, will be available on a phased basis to customers who already have Caixa Tem digital accounts, according to their birthday month.

For example: for those born in January and February, the option is already available from Monday (27). The opening of an account in the Caixa Tem app for new users begins on the 8th of November, also in a staggered manner taking into account the month of birth.

Recruitment can be done in two ways

1) Caixa Personal Credit: – a loan with a free allocation of everything the customer needs, including its use for personal expenses, such as debt payments;

2) Cash Credit for Your Business: A loan for productive investment directed toward your business expenses, such as getting money to pay suppliers, water, electricity, internet bills, rent, purchasing raw materials and/or merchandise for resale, among others.

The difference between the two lines of credit is due to the destination of the contracted resources. In both cases, the contract value ranges from R$300 to R$1,000. It is noteworthy that the interest rate is 3.99% per month, with installments up to 24 installments.

What do you do to contract a credit line?

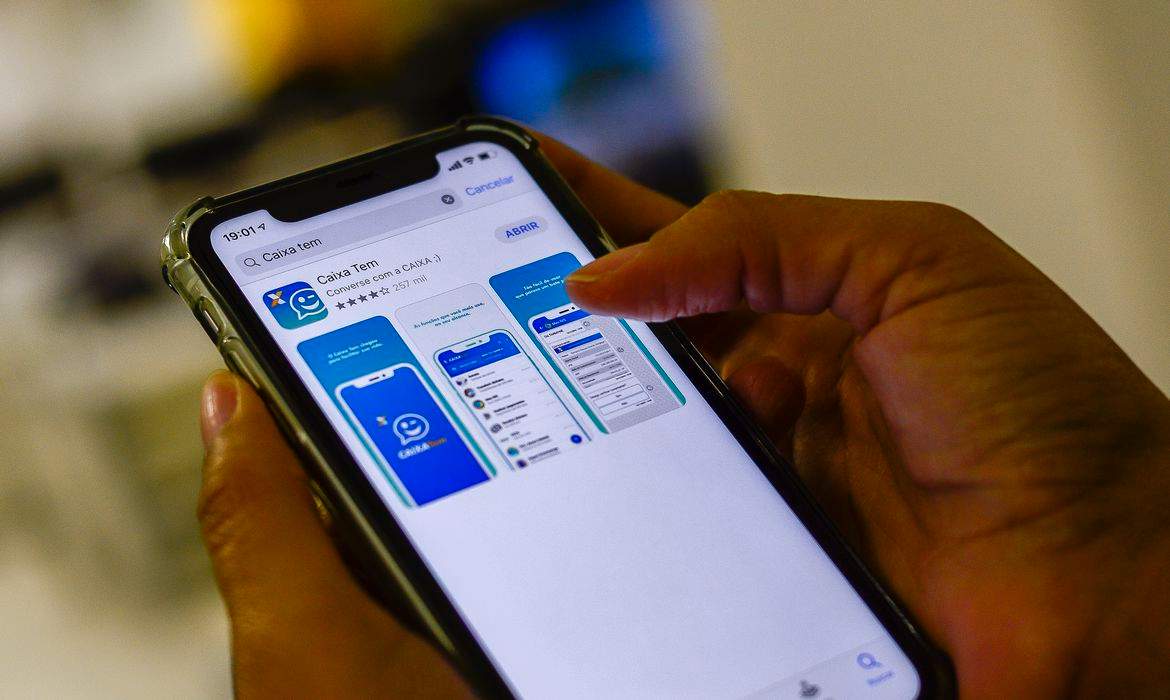

According to the information provided by Caixa, first, the customer needs to update “CAIXA Tem” for free in Google Play App Store or Apple Store.

Next, you have to access the application and select “Update your registration” in the menu. From then on, every step of the update involves scanning the user ID document and the photo in “selfie” format. Within 10 days, the client’s registration evaluation will be completed.

After the registration update process is completed, the customer’s account changes from CAIXA Digital Social Savings to Digital + Savings. The loan is credited exclusively to the customer’s digital savings account + after contracting. Installments are deducted monthly from the same customer account.

More information on how to get credit, make payments and even pay off the loan is available on the website www.caixa.gov.br/caixatem.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!