Among the measures studied were Card Rotability, Automatic Pix, BolePix, and Guaranteed Pix; Learn the main details

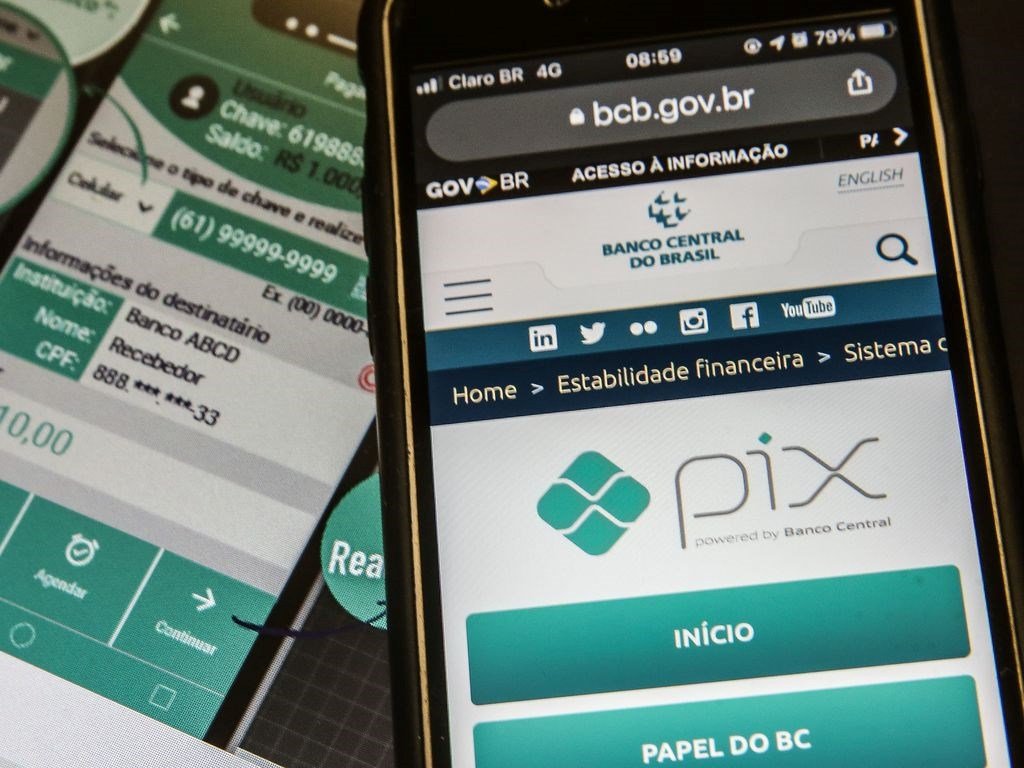

a central bank (BC) Novelties were taught to pixwhich is a system of instant transfers and payments that has become popular in Brazil, also analyzes the possibility of making credit card debt portability effective.

Some of these possible actions were predicted by the Director of Financial System Regulation and Resolution, Renato Dias de Brito Gomez, in an interview with O Estado de S. Paulo newspaper.

Watch what’s going on:

Rotability

According to Gomez, the portability of the Rotary, already in use in the United States, would increase competition. The model would allow consumers to choose the bank of their choice to pay down debt and negotiate lower rates. “If the subject does not transfer card debt from one institution to another, there will be little pressure on interest rates,” says the BC manager.

Transferability is already possible in Brazil, but according to BC, there are many difficulties in the case of revolving debt. “Revolving interest rates are at very high levels. That raises a lot of anxiety in the government. Here in British Columbia, there is also anxiety in the face of these inflated numbers,” says Gomez.

In April (last data available), interest on revolving credit cards was 447.7% annually, the highest level since 2017. Defaults topped 51% in the period.

What’s new in Pix

related to pixBC is considering creating Pix Automático, which would be a more advanced version of Auto Discount. Currently, this model works through an agreement between the service provider and the banks. If a customer wants to perform the automatic debit, they must be a customer of one of these banks that have an agreement. With Automatic Pix, payment can be made directly.

According to BC, Pix Automático will work for telephony, energy, streaming, recurring payments and long-term product purchases, among other examples.

polypix

BolePix will be a Pix version of boleto – an iteration of boleto, in fact. In this case, the QR code will appear as a ticket and the customer can make the payment via Pix. The system will already inform, at the time of payment, whether the bill has been paid or not. BC expects BolePix to start operating in 2024.

Pix guaranteed

Still in the development phase, Pix Garantido is a solution that will stimulate competition for the credit process at the point of purchase.

In practice, it will be possible to install purchases through Pix, guaranteeing receipt to whoever sells.

“There are solutions where a (consumer) completes a purchase and the company contacts (connects) financial institutions that will offer a credit option to finalize the purchase via Pix,” says the BC manager.

“Since there are so many opportunities and we don’t know exactly how the business model will progress, we’ve taken a step back, and we’re watching how it progresses. But it’s something we see with good eyes,” Gomez continues.

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!