BMG Bank (BMGB4) reported net recurring net income of R$48 million in the fourth quarter of 2021 (Q4 of 21), which is 49.8% lower than in 2020.

The net accounting income was R$48 million in the fourth quarter of 21st, a decrease of 36.7% compared to the same period in 2020.

Return on average equity (ROAE) was 5.0% between October and December 2021, down 4.9 percentage points from the same period in 2020.

In Q421, financial margin was R$901 million, down 0.9% from the immediate prior quarter and 6.1% from Q4 2020.

According to BMG, margins have compressed in recent quarters, initially due to a lower average portfolio rate due to product mix, and more recently due to an increase in the cost of funding caused by the increase in the yield curve.

More data from Banco BMG’s balance sheet (BMGB4)

BMG’s loan portfolio totaled R$15.967 billion in Q421, representing an increase of 6.1% in the quarter and 14.0% in twelve months.

Service revenue totaled R$21 million in the fourth quarter of 2011, an increase of 11.8% over the same period last year.

Banco BMG’s total customer base reached 9.1 million in December 2021, an increase of 50.5% in the last twelve months, taking into account central bank criteria. Of the total number of customers, 57% have credit products.

BMG has recorded a 2.4-fold increase in the number of accounts over the past 12 months, to 6.3 million digital accounts, with growth in transaction and digital banking indicators. Cash in customer accounts reached R$10 billion throughout 2021.

Continue after the ad

guiding rules

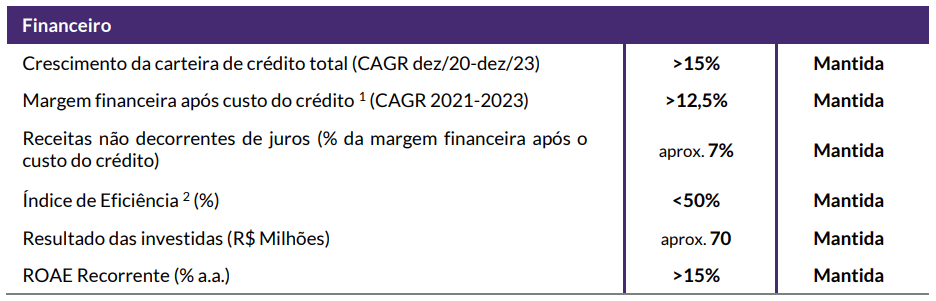

BMG also communicated its forecast for fiscal year 2022 and reaffirmed its view of financial indicators for 2023. According to BMG, the base scenario for both lines is the center of the range.

See key indicators

BMG . 2023 Predictions

Regarding the year 2023, the management informed that it chose to suspend the views of the operational indicators, which were revealed by a material fact on March 30, 2021, “because it is aware that these indicators do not reflect the strategy of the emirate that the bank seeks with its customers.”

Buying opportunity? XP Strategist reveals 6 cheap stocks to buy today. Watch here.

Related

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!