increase in Principal interest rate (CEL) By the Monetary Policy Committee (Copom) of the central bank the fixed income yield is taken. In the case of Nubank customers, just leaving the money in the account is worth more than putting it into savings.

Read more: ‘Forgotten money’: Millions of Brazilians still have values they deserve; Know when to recover

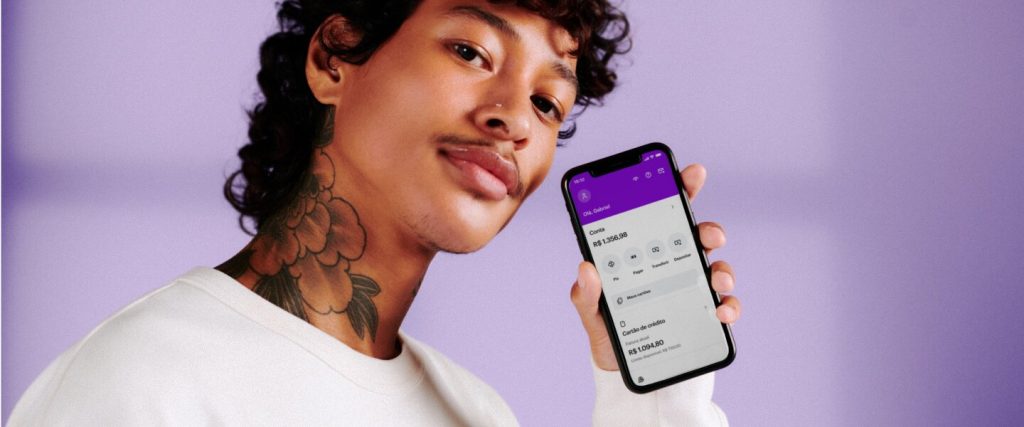

account financial technology It has a higher automatic return on savings, equal to 100% of the Certificate of Deposit Interbank (CDI). Knowing this, see the following How much does 1000 BRL earn in Nubank with Selic at 12.75%.

highest return

CDI’s 100% currently guarantees an annual return of 12.65%, which is very close to Selic’s rate. This means a monthly return of just over 1%.

If the customer deposits 1,000 RRL and lets it earn for two years, at the end of this period, he will be able to withdraw R$ 1,221.93. An income tax deduction is already provided for this amount.

For comparison, the savings Today he pays 0.50%, because the prime rate is above 8.5%. This same R$1,000 in a traditional brochure will bring in R$1,130.61 after two years. The difference between the two options is about 91.32 BRL.

Although savings are exempt from income tax, a Nubank account is still worth it. See the full comparison table:

| Nobank account | savings | |

| Value applied | A thousand Brazilian riyals | A thousand Brazilian riyals |

| Total total balance after 2 years | 1269 BRL | 1130.61 BRL |

| Gross net balance (deducted from income tax) after 2 years | 1221.93 Brazilian Real | 1130.61 BRL |

| total gross income | 269 BRL | 130.61 Brazilian Real |

| total net income | 221.93 Brazilian Real | 130.61 Brazilian Real |

“Hardcore beer fanatic. Falls down a lot. Professional coffee fan. Music ninja.”

More Stories

Sabesp Receives Brazil Innovation Value Award 2024 • PortalR3

Total formal job creation reached 201.7 thousand in June, up 29.6% | Economy

10,000 Brazilian Reals are waiting for you at Nubank? Find out who can get this money!