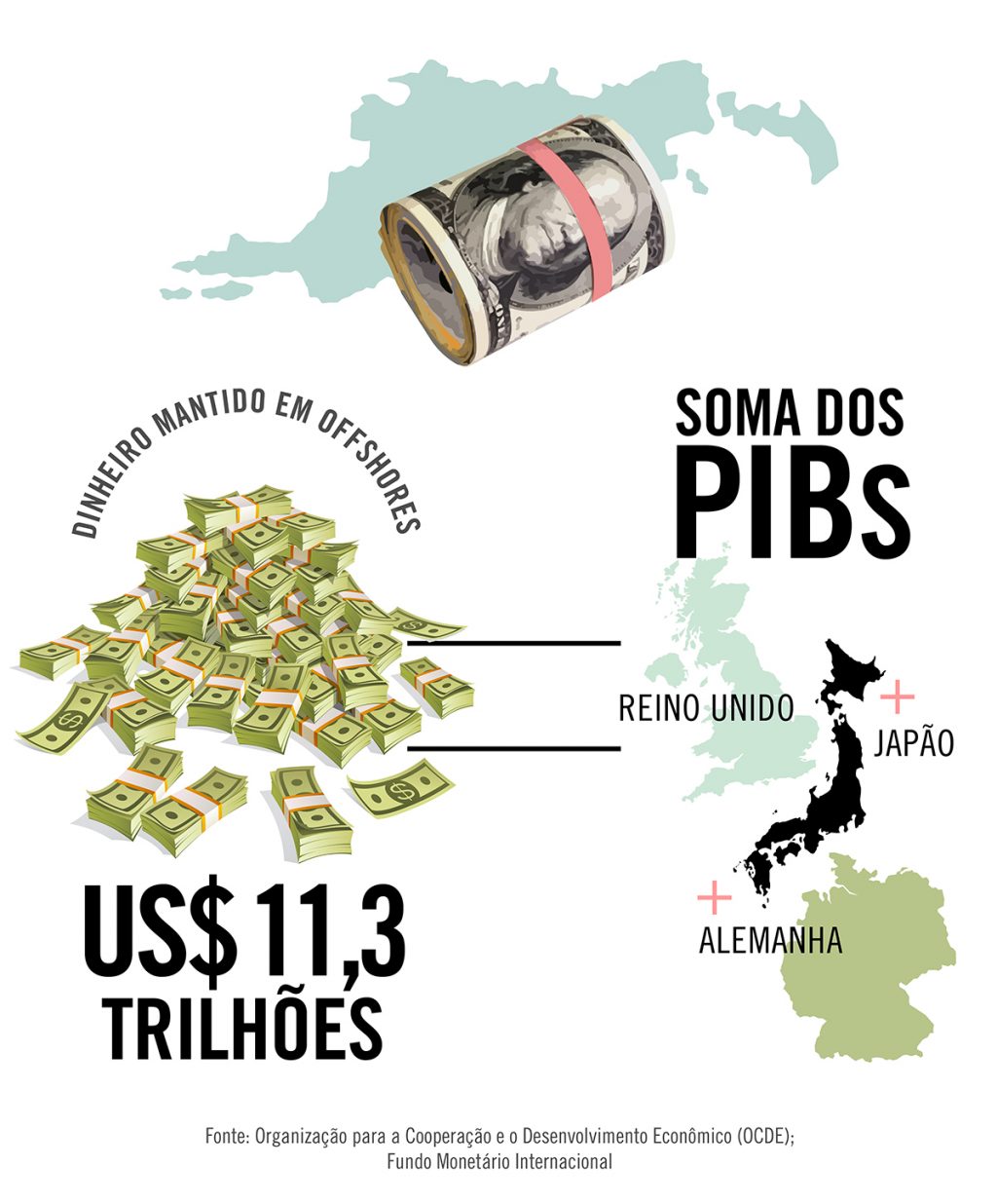

D.According to a study by the Organization for Economic Co-operation and Development (OECD), at least $ 11.3 trillion is “at sea”, that is, outside the country where the company’s owners live. This value is equivalent to the GDP of Japan, Germany and the United Kingdom. These countries are one of the five richest in the world and GDP represents the sum of all the final goods and services they produce..

Leaving a company out of the country is not illegal. The problem is, these efforts can be used for tax evasion – or to cover up illegal businesses. In general, tax havens offer benefits such as secrecy, low taxation and easy liability. Therefore, it is impossible to know how much of this 11 trillion is related to tax evasion and other crimes.

The Federation of Investigative Journalists opened the box of Coastal Pandora. Millions of documents leaked from government offices around the world revealed the financial secrets of more than 330 high-ranking politicians and civil servants, including world leaders, ministers and ambassadors from 91 countries. Among them, the Minister of Economy, Paulo Quitz and the head of the Central Bank, Roberto Campos Neto.

![[VÍDEO] Elton John’s final show in the UK has the crowd moving](https://www.lodivalleynews.com/wp-content/uploads/2023/06/Elton-John-1-690x600.jpg)

More Stories

What is early voting about voting on November 5th?

King Charles visits health center in India – 10/30/2024 – Celebrities

Pending home sales in the U.S. have risen for more than four years